California Gasoline Stimulus - A gas nozzle in a van at a gas station in downtown Fresno on September 29, 2022. Photo by Larry Valenzuela, /CatchLight Local

Here's who's eligible for the gas rebate in 2022, how you'll get it, when and how much you should expect.

California Gasoline Stimulus

California is sending money directly to millions of residents to help with rising costs and high gas prices.

California's Gas Tax Hike Takes Effect Friday. Why Did Efforts To Stop It Fail?

The payments, which went live on October 7, range from $200 to $1,050 depending on income and other factors. About 18 million payments will be distributed over the coming months, benefiting up to 23 million Californians. Cash payments are part of the June budget agreement.

Spoke with the State Franchise Tax Office to analyze what this means for you. Check out our tool at the bottom of this article to see how much you'll get.

To be eligible, you must file your 2020 California tax return by October 15, 2021. There is an exception for people who didn't file by the October deadline because they were waiting for an Individual Taxpayer Identification Number (assuming they filed one). until February 15, 2022).

Payments also won't go to spouses or domestic partners who have adjusted gross income above $500,000. The same is true for many individuals who have adjusted gross income above $250,000.

Stimulus Update: Here's Who Can Expect To Receive The Proposed $100 Monthly Gas Stimulus Payment

You must also be a California resident for at least six months of 2020 and be a resident at the time your payment is issued.

Payments are open to undocumented California citizens with a valid Taxpayer Identification Number or Social Security Number who have filed a complete 2020 tax return and meet all eligibility requirements.

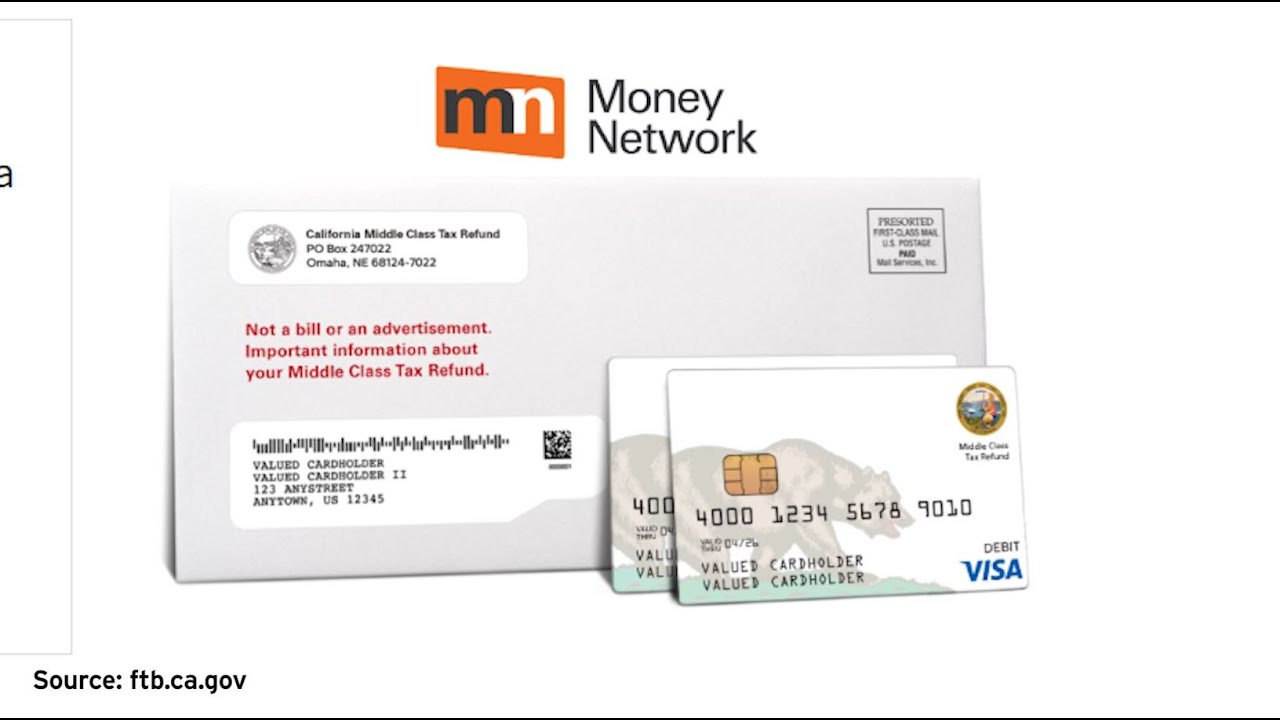

People who are entitled to the payment will receive it either by direct deposit into their bank account or by postal debit card, according to the tax commission. Generally, people who filed their 2020 tax return online and received their state tax refund via direct deposit will receive a direct deposit. Most other eligible individuals receive debit cards by mail. The envelope will be clearly marked with the phrase "Middle Class Tax Refund".

The first round of payments will go to people who received one of the two 2021 Golden State Stimulus payments and are eligible for direct deposit. The first round of payments is expected to take place between October 7 and October 25.

People In California Get Inflation Relief Payments Friday. Here's Who

The rest of the direct deposits are expected to be completed between October 28 and November 14. According to its website, the IRS expects 90% of direct deposits to be sent in October.

Debit cards for people who received one of the Golden State Stimulus payments are expected to be shipped between October 25th and December 10th. All remaining debit cards are expected to ship by January 15th.

Why can't they all be sent at once? "There are limits on the number of direct deposit and mail-in debit cards that can be issued each week," said Andrew LePage, a spokesman for the franchise tax office. "Logie needs time to efficiently and accurately deliver approximately 18 million payments to Californians, protecting taxpayers and California."

We have created a tool for you to search for it. The Franchise Tax Board also has information as well as a customer help line that can be reached at 800-542-9332. The helpline has assistance in English, Spanish, Mandarin, Hindi, Vietnamese, Korean and Punjabi. The board says that additional languages may be supported upon request.

Stimulus Update: These States, Cities Are Offering Up To $1,050 Due To High Gas Prices

A disproportionate share of catalytic converter theft occurs in California. Here's what lawmakers are trying to do about it, and why one law enforcement-backed approach hasn't made it out of Sacramento.

The campaigns for Propositions 26 and 27 on this November's ballot have made various claims, particularly about how money collected from California sports betting will be distributed.

Want to submit a guest comment or reaction to an article we've written? Our submission guidelines can be found here. For any questions please contact: commentary@

Is a nonprofit newsroom, and your tax-deductible donations help us continue to bring you and all Californian essential, unbiased information.

California To Raise Its Gas Tax, Already The Highest In The Nation

Grace powers California's economy. She was previously an editor at Washington Monthly. She is a graduate of Pomona College. More by Grace GedyeGas stimulus check: What is the $400 rebate proposed by California Gov. Gavin Newsom? California has the highest gas prices in the nation, and the state's governor, Gavin Newsom, has released a proposal to cut energy and transportation.

The average price of a gallon of gasoline, breaking previous records, reached $5.80 in California last week. The price is two dollars higher than the $3.76 that consumers saw this time last year.

In response to these increases, Governor Gavin Newsom proposed a legislative package that would provide direct relief to families throughout the Golden State.

"This package also focuses on protecting people from fluctuating gas prices and promoting clean transportation — providing three months of free public transit, rapid electric vehicles and charging stations, and new funding for local projects for bicyclists and pedestrians," the governor said. News describing the package.

What A Federal Gas Tax Holiday Could Mean For Prices At The Pump

NEW: We're offering $11 billion in relief, including a $9 billion tax refund for rising gas prices. - $400 per registered car - 3 months free public transport pic.twitter.com/XsAn0kuokP — Gavin Newsom (@GavinNewsom) March 23, 2022

Most of the $11 billion aid package, about $9 billion, is allocated to pay a direct payment of $400 for each vehicle a household owns.

There is a two vehicle limit and residents should be aware that the bill limits the number of times this convenience can be claimed to two. Each year, California drivers save about $300 in state excise taxes on gasoline and diesel, and the direct payment is intended to offset those costs.

The bill also appropriates funds "to suspend the inflationary adjustment of gas and diesel tax rates." These rates are tied to price. If the rate is five percent and prices go up, the cost to consumers is higher and the state is trying to avoid that.

Bad News: California's Gas Stimulus Payment Likely Delayed Until October

To avoid excluding "parents receiving Social Security disability income and low-income non-tax filers," Newsom's proposal would provide a discount to anyone with a vehicle registered with the California Department of Motor Vehicles.

"The governor's proposal has no income cap to include all Californians who face higher prices due to the price of oil," the governor's office said in a news release.

To encourage the use of public transit systems, the bill also includes "$750 million in active grants to transit and rail agencies to provide free transit for Californians for 3 months."

Every day in the state, millions of people use public transportation systems, and Governor Newsom hopes that by making these systems free, he will encourage riders to continue using the bus, train or light rail.

Newsom To Hike Minimum Wage As Part Of California Blueprint Package

The proposal is also forward-looking, as it includes financing the construction of a larger number of charging stations for electric cars. The goal of this section of the bill is to encourage Californians to consider purchasing an electric vehicle the next time they are in the market for a new car.

In fact, about eighty-seven percent of cars in the state run on gasoline. But in 2020, the number of electric vehicles on the road exceeded 635,000, and the most popular model is the Tesla Model 3. The middle class tax refund is a one-time payment to help California residents who filed their 2020 tax returns last October.

Payments will range from $400 to $1,050 for couples filing jointly and $200 to $700 for other individuals, depending on the amount of income and dependents claimed.

The state said it began issuing the money two weeks ago, but payments have been slow to roll out, said Hisham Foad, chairman of San Diego State University's economics department.

Stimulus Update: $100 Monthly Check Proposed To Cover High Gas Prices

"The bigger problem with the delay is that people could see these messages, like 'oh, we're going to get the money,' and maybe change their behavior because of that," Foad said.

The state is currently in the first phase of sending tax returns, and the next batch will begin accepting payments on October 24.

Those who filed their 2020 taxes electronically and received a refund via direct deposit will have their payment made via direct deposit by November 14.

Other users should expect to receive money in the mail on their debit card by January 2023.

Gas Rebate Checks To Start Going Out For California Residents Next Week

"Someone may have increased the purchase because they expected to receive that check by the end of October. If it's delayed until November or later, then that could cause some problems," Foad said.

“But of course not everyone will understand. You had to file a tax return – or rather pay taxes – to get that relief,” Foad said. “And there are quite a few people who are being hit hard by inflation, those on really low incomes who didn't pay taxes last year. ."

The Franchise Tax Board expects so

California stimulus check 2021, california stimulus check qualifications, california stimulus check status, stimulus check for california, stimulus checks california, california stimulus check eligibility, california stimulus, california stimulus check application, $600 california stimulus check, stimulus check in california, stimulus for california, new california stimulus

0 Comments